Understanding Boat Insurance

Understanding Boat Insurance: Everything You Need to Know

Owning a boat brings joy and freedom, but protecting it with the right insurance is essential. This guide covers everything you need to know about understanding boat insurance, from policies to coverage for critical components like your outboard lower unit and propellers. Let’s dive in!

What Is Boat Insurance and Why Do You Need It?

Boat insurance provides financial protection for your vessel, covering repairs, replacements, and liabilities. Without it, you may face costly out-of-pocket expenses for damages to your outboard lower unit, propellers, or hull.

Benefits of Boat Insurance:

- Damage Coverage: Protects against accidents, storms, or vandalism.

- Liability Protection: Covers legal and medical costs if you’re at fault.

- Component Coverage: Includes parts like the outboard lower unit and navigation systems.

Types of Boat Insurance Policies

1. Comprehensive Coverage

Comprehensive policies cover a wide range of damages, including weather-related incidents and theft.

- Includes coverage for the outboard lower unit and propellers.

- Often required for financed boats.

2. Liability Insurance

This type of insurance covers damages you cause to others.

- Protects against lawsuits and medical costs.

- Does not cover damages to your boat or outboard lower unit.

3. Specialized Component Coverage

Policies can include specific coverage for:

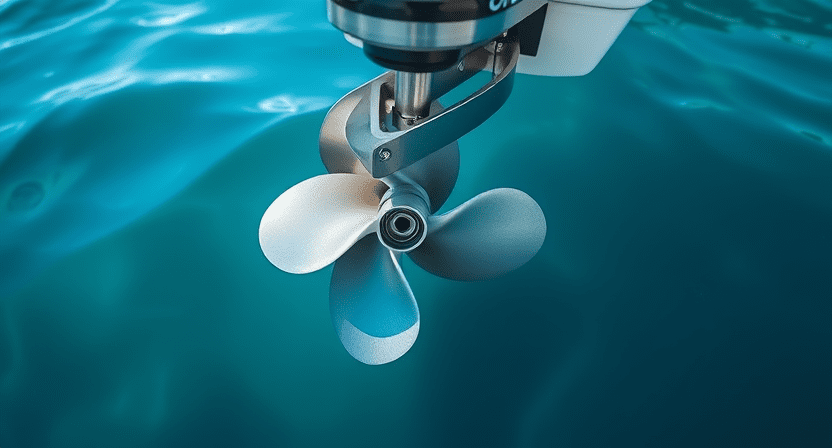

- Outboard Lower Units: Essential for propulsion and steering.

- Propellers: Protects against accidental damage or loss.

- Electronic Systems: Includes navigation and communication equipment.

What Does Boat Insurance Typically Cover?

1. Physical Damage

Covers repairs for damages to:

- Hulls and decks.

- Outboard lower units and propellers.

- Anchors, masts, and sails (for sailboats).

2. Theft and Vandalism

Protects against stolen components or vandalized property.

3. Environmental Liability

Covers clean-up costs if your boat causes pollution, such as an oil spill from the outboard lower unit.

4. Medical Payments

Provides coverage for injuries sustained by passengers or crew.

Factors That Affect Boat Insurance Costs

1. Type of Boat

Larger, more expensive boats cost more to insure.

- High-performance boats may have higher premiums.

- Sailboats often cost less than motorboats.

2. Location and Use

Where and how often you use your boat impacts costs:

- Coastal areas may have higher premiums.

- Limited-use discounts are available for seasonal boating.

3. Deductibles and Coverage Limits

Higher deductibles reduce premiums but increase out-of-pocket costs during claims.

How to Choose the Right Boat Insurance

1. Assess Your Needs

Identify essential coverage areas:

- Do you need coverage for your outboard lower unit?

- Are you frequently in high-risk waters?

2. Compare Providers

Research multiple insurance companies for the best rates and coverage.

- Look for marine-specific insurers.

- Read customer reviews and testimonials.

Tips for Lowering Your Boat Insurance Premiums

- Complete a Boating Safety Course: Many insurers offer discounts for certified courses.

- Install Safety Equipment: Alarms, GPS, and fire extinguishers can lower premiums.

- Bundle Policies: Combine boat insurance with home or auto insurance for discounts.

- Maintain Your Boat: Regular upkeep of your outboard lower unit and propellers reduces claims.

Real-World Examples of Boat Insurance Claims

1. Storm Damage

A hurricane caused severe damage to a boat’s hull and outboard lower unit, but comprehensive coverage covered all repair costs.

2. Propeller Theft

A stolen propeller was replaced under specialized component coverage.

3. Collision Liability

A boater at fault in a marina collision avoided lawsuits with liability insurance.

Conclusion

Understanding boat insurance is crucial for protecting your vessel, whether it’s covering damage to your outboard lower unit or liability from accidents. Choose a policy tailored to your needs and maintain your boat to minimize risks. Start safeguarding your investment today with these tips.

Read Next: Check out our Eco-Friendly Boating Tips for Sustainable Adventures for more ways to care for your boat responsibly.